What Is A Halal Mortgage?

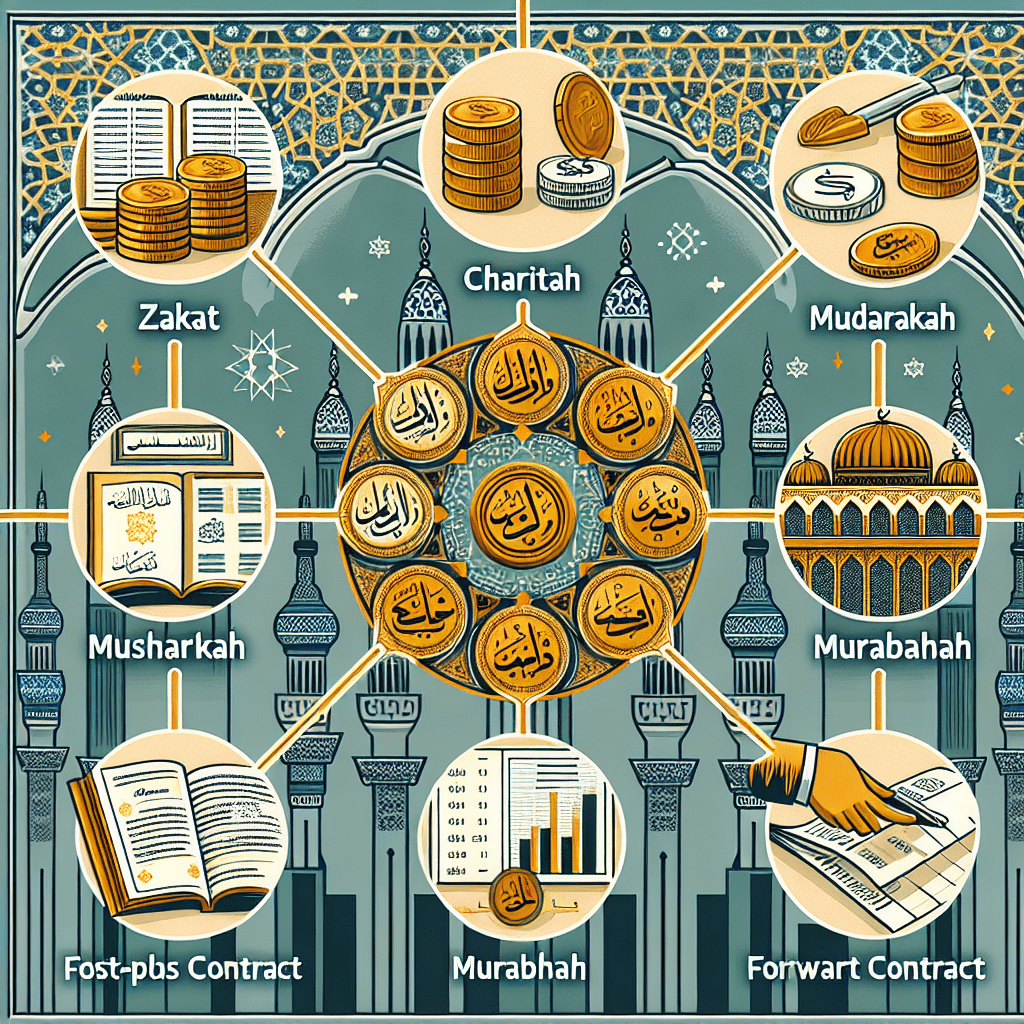

Halal mortgages follow Islamic principles, offering Sharia-compliant financing without interest. Islamic banks provide two common types: Murabaha and Musharaka. Unlike conventional mortgages, Islamic ones avoid property resale and utilize plans like Ijara and Musharaka. Ijara contracts involve